Mis Sold Sipp Compensation - An Overview

All About Sipp Claims

Table of ContentsMis Sold Sipp Claim Things To Know Before You Get ThisSee This Report on Mis-sold SippsLittle Known Questions About Mis Sold Sipp.Mis Sold Sipp Compensation Fundamentals Explained

We can educate you whether you have actually been mis-sold and assist you get your pension back.

As well as do not worry settlement or remedy can be paid directly to a bank account of your selection and also you might not have to deal with the SIPP once more after the insurance claim has actually been settled! Right here are some instances which may aid you to comprehend what could occur: Mr X moved his personal pension of 45,000 right into a SIPP to invest right into an abroad building.

The property was allow and he was getting some revenue (300 every 3 months) yet this simply covered the yearly SIPP costs and also fees. The assured returns had actually never ever been obtained and also when he asked the firm to sell his apartment so that he can spend his cash someplace else, the firm described that there was no redeem alternative readily available and also no purchaser might be discovered.

The Main Principles Of Sipp Claims

He had 2,000 money left in his SIPP financial institution account, which is the minimal cash money balance the SIPP service provider needs to cover the annual costs and admin charges. The financial investment was still valued 36,000. Mr X's pension plan was with Zurich. We checked out his instance and also determined that he was provided with unsuitable advice.

Zurich confirmed his pension would now be worth 94,000. As the residential property might not be sold, the IFA firm was asked to take over the financial investment and also pay compensation to put our client into the position he would certainly have remained in if it wasn't for the company's improper advice. Mr X received 92,000 remedy (94,000 minus SIPP money balance) and the company was asked to take control of the investments, so he can close the high risk financial investment along with the SIPP.

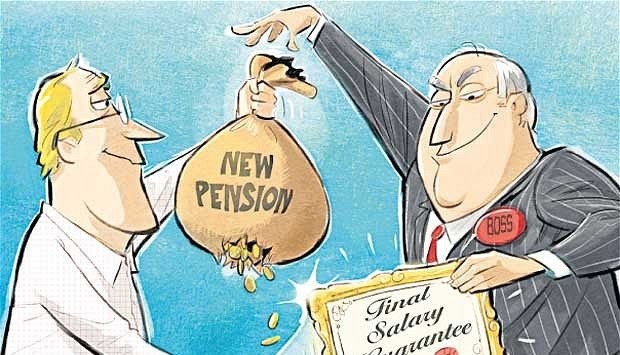

Lots of mis-sold SIPP customers have been mis-led regarding the performance of the financial investments they consist of.

Some Known Incorrect Statements About Mis Sold Sipp Compensation

Most of investments linked with these SIPPs disagree for the typical retail client, and also must only be advised to individuals with a specific risk account and investment experience. SIPPs are not appropriate for everyone due to the underlying financial investments they have. They are also unsuitable for individuals with little investment experience or who do not have the understanding and also ability for threats associated with this kind of pension plan plan.

Pension savers mis-sold a SIPP have their hard-earned money tilled right into uncontrolled investments, commonly for the financial investment to choke up, sometimes to the point where the whole pension fund is lost. SIPP Complaints made to the Financial Ombudsman Solution amounted to greater than 3 thousand in 2018 and they are the most complained regarding pension plan product versus Financial Advisers.

If you were suggested to invest right into a Self-Invested Personal Pension without being planned for the risks, you may be due payment.

Do you assume your pension plan was mis-sold to you? Possibly you really felt pressured by advisers to change your existing pension to a SIPP that had not been ideal or suitable for your requirements? If you assume you have actually been mis-sold a pension plan or were provided negative suggestions on your financial investments from a Financial Adviser or SIPP Service Provider, that has actually cost you economically, you may be entitled to payment.

10 Simple Techniques For Mis Sold Sipp Compensation

A SIPP is a self spent individual pension go to these guys plan. It is, essentially, a DIY pension pot which enables you (the investor) to spend in multiple and also extra diverse financial investment products than the majority of common pension plans, consisting of a wide range of plans, numerous of which are perfectly genuine (mis sold sipp claim). Over the last three decades, SIPPs have verified to be an extremely popular pension plan choice, with greater than one million people in the UK having spent their hard earned financial savings right into them due to the fact that of the numerous benefits they can use, consisting of: flexibility with the kinds as well as quantity of investments you can go into; risk diversification; the option to handle them on your own; more control over your money as well as financial investments; tax advantages; the pledge of much better returns and the choice to have aid from an independent financial advisor who can make investments in your place.

Consequently, those financiers have actually lost financially, in some cases having their whole financial savings erased. Likewise, one more problem related to SIPPs mis-selling has been the buzz and also overselling of benefits with several advisors overstating the great, not-to-be-missed financial investment chances and read review the guarantees of massive returns, in really short timescales, which never ever happened and later on became just untrue.